This year is Avistone’s 10-year anniversary, and we want to thank each of our investors for the confidence placed in us to deliver returns above industry benchmarks.

We are proud to say that Avistone has weathered the volatility of the past three years quite well having completed the sale of all our industrial properties at top of the market pricing. Today, Avistone is well positioned to take advantage of lucrative opportunities in the next downturn.

As we head into 2023, we are optimistic that we may be nearing the bottom of a market cycle within the next 12 months presenting the most compelling investment opportunities that we have seen in the decade.

Since our inception in 2013, Avistone has operated a multi-tenant (flex) industrial platform, and more recently added a hospitality platform to capture opportunities arising from the Covid-19 pandemic and recent boom in the travel market. To date, we have acquired and sold 24 flex industrial properties and three hotels representing more than 4 million square feet of space in California, Georgia, Ohio, Texas, Virginia, and Florida.

4.1 MILLION SQ FT

In Acquisitions

19.01%

Weighted Internal Rate of Return

3.38 YEARS

Weighted Hold Period

24

Full Cycle Investments

1.55%

Weighted Investment Multiple

8.19%

Weighted

Yearly Distribution Yield

Being longer-term bullish does not mean we don’t take a hard-nosed view of reality. We expect the next several months to be challenging, with recessionary conditions in certain sectors getting worse before they get better. However, history shows that contrarian investors that “buy the dip” most often get rewarded when the markets stabilize. To fight inflation, the Federal Reserve has raised the Fed Funds rate to 4.5%, with predictions of a 5% rate by mid-year. While we believe the rate of increase of inflation has now slowed, at least in the near-term, we expect higher inflation and interest rates to continue for the foreseeable future than those in the recent past.

While no asset class is immune from inflationary pressures and increasing interest rates, we believe historically, income-producing real estate assets have proven to be one of best hedges against inflation, while providing wealth protection and increasing income over time.

Over the next year, we believe the key to finding and realizing the best investment opportunities will go to those with liquidity, strong creditworthiness, the ability to act quickly and to borrow at rates considerably higher than only 12-months prior. Longer term, when rates decline, refinancing opportunities will enhance cash distributions and increase overall returns.

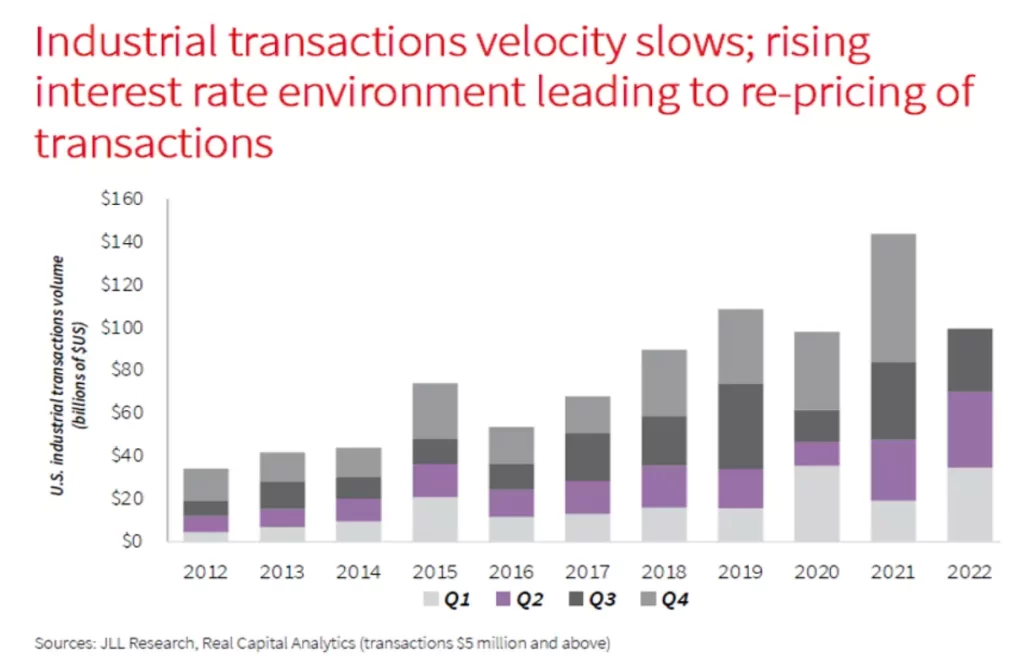

Over the last few years, Avistone has been a seller of flex industrial properties. We have not acquired a new flex industrial property since February of 2021. In our opinion, market prices were over-heated and the risk/return proposition did not meet our high standards. We patiently watched from the sidelines as historically low interest rates and insatiable investor demand resulted in exceedingly high prices for flex industrial properties.

At the same time, the extraordinarily high cost of construction due to material shortages kept nearly all multi-tenant industrial development at bay. The vast majority of new industrial development during this period was large space of at least 50,000 square feet; in contrast, the average tenant size of our nearly 4 million square foot flex industrial portfolio was 6,000 square feet.

Over the last several months, the investment market has changed abruptly and dramatically as interest rates have risen from the mid-3% range to over 6% for flex industrial space. Interest rate increases and the threat of a slowing economy have cooled the investment market resulting in reduced prices. Because of this, we are currently seeing cap rates for flex industrial properties in the 6% to 7% range, while tenant demand, occupancy, lease rates, and market dynamics remain healthy. We believe this gives us the opportunity to, once again, acquire industrial properties with attractive yields, inflation protection and the opportunity for capital appreication.

Today, we believe that the combination of reduced prices, relatively high interest rates, high occupancy, as well as an under-supply of new space has potentially given us an exceptional buying opportunity in the flex industrial space. We are currently seeing buying opportunities that offer the yield and value our clients have come to expect.

We are optimistic that 2023 will be another busy and productive year for the Avistone team. We greatly appreciate your ongoing loyalty, support and confidence in our ability to bring you high quality and expertly managed investments. We will continue to work hard to earn your business and trust, and to ensure your experience with us remains positive and profitable.

© 2024 Avistone, LLC. All rights reserved.

*IMPORTANT DISCLOSURES: This communication is intended exclusively for the private and confidential use of accredited investors. It is transmitted by the sponsor of the investment opportunity, Avistone, LLC, or one of its affiliates (referred to as "Avistone" or "Sponsor") and is provided solely for informational purposes. All information and opinions contained herein, including assumptions and projections (collectively referred to as "Projections"), are furnished by the Sponsor. The Sponsor and its affiliates make no representations or warranties regarding the accuracy of such information and disclaim any liability in this regard. None of the content in this communication is intended to create a binding obligation on the part of the Sponsor or its affiliates. This communication is fully qualified by reference to the comprehensive information regarding the offering set forth in the Sponsor's offering documents, including any private placement memorandum, operating agreement, and subscription agreement (collectively referred to as "Offering Documents"), which should be carefully reviewed before making any investment.

The Projections provided by the Sponsor, including target IRR, target cash-on-cash, and target equity multiple (referred to as "Targets"), are hypothetical and are not based on actual investment results. They are presented solely to provide insight into the Sponsor's investment objectives, outline anticipated risk and reward characteristics, and establish a benchmark for future evaluation of the Sponsor's performance. The Sponsor's Projections and Targets do not constitute predictions, projections, or guarantees of future performance. There is no assurance that the Sponsor will achieve these Projections or Targets. Forward-looking statements, including the Sponsor's Projections and Targets, inherently involve a variety of risks and uncertainties, and actual results may substantially and materially vary from those anticipated. Refer to the applicable Offering Documents for disclosures concerning forward-looking statements. Projections and Targets, including forward-looking statements, should not be the primary basis for an investment decision. Avistone and its affiliates do not provide any assurance regarding returns, or the accuracy or reasonableness of the Projections or Targets provided by the Sponsor. Past performance does not predict future results. The historical performance record of Avistone is not indicative of future outcomes. Third-party audits have not been conducted on the performance of Avistone's prior projects. Differing property offerings and commitment dates for individual property offerings resulted in varying returns for investors.

The metrics of the Full-Cycle Track Record on industrial properties are calculated based on weighted averages that treat investment dollars equally and are computed by aggregating the outcomes of all Avistone full-cycle industrial property investments, with weights corresponding to the respective capitalization amounts for each Full Cycle Investment. This real estate investment is speculative and involves substantial risk. There is a potential for a partial or complete loss of principal investment and should only be undertaken if you are prepared to bear the consequences of such a loss. Thoroughly review all of the Sponsor's Offering Documents, including any "Risk Factors" therein. For additional information concerning risks and disclosures, please visit https://www.avistone.com. None of the content in this communication should be considered investment advice, whether regarding a specific security or an overall investment strategy. Reproduction or distribution of this message to any individual or entity outside the recipient's organization is prohibited without the express consent of Avistone.