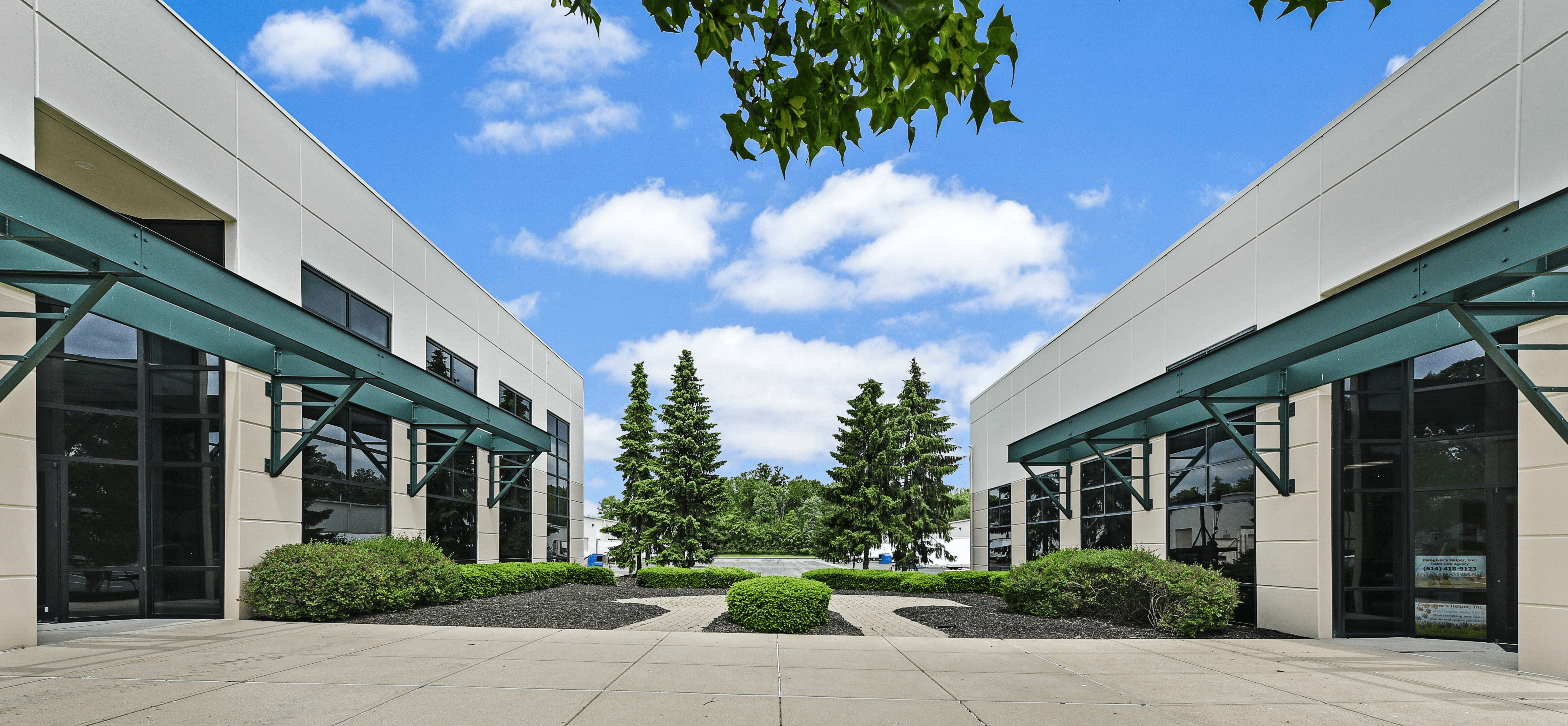

Why Multi-Tenant Industrial Properties in 2025?

Avistone remains committed to acquiring and managing multi-tenant industrial properties nationally, a specialized asset class that provides distinct advantages compared to other real estate sectors:

Diverse Tenant Base

Multi-tenant industrial properties attract a broad spectrum of tenants from various industries, drawn to flexible and cost-effective spaces. The diversity of tenants offers several key benefits:

These factors contribute to operational stability, which is crucial for maintaining consistent revenue streams in an evolving market.

Value-Add Opportunities

Avistone actively seeks value-add opportunities in underperforming properties, focusing on assets with significant potential for improvement:

Through space reconfiguration, aesthetic improvements, and driving occupancy, Avistone enhances a property’s appeal and revenue potential, ultimately delivering strong exit values and attractive returns for investors.

Decreasing Supply, Increasing Demand

The supply of multi-tenant industrial properties continues to decrease due to several factors:

These supply-demand dynamics make multi-tenant industrial properties a highly attractive investment opportunity in 2025, particularly in high-growth markets where space is limited.

Conclusion

Avistone’s strategic focus on acquiring and managing multi-tenant industrial properties is well-aligned with favorable economic and market conditions in 2025. The combination of a diverse tenant base, significant value-add potential, and favorable supply-demand dynamics ensures stability and growth opportunities in this asset class. By leveraging our expertise in identifying and repositioning underperforming assets, Avistone is positioned to deliver exceptional investment opportunities that capitalize on the evolving industrial real estate landscape, both in 2025 and beyond.